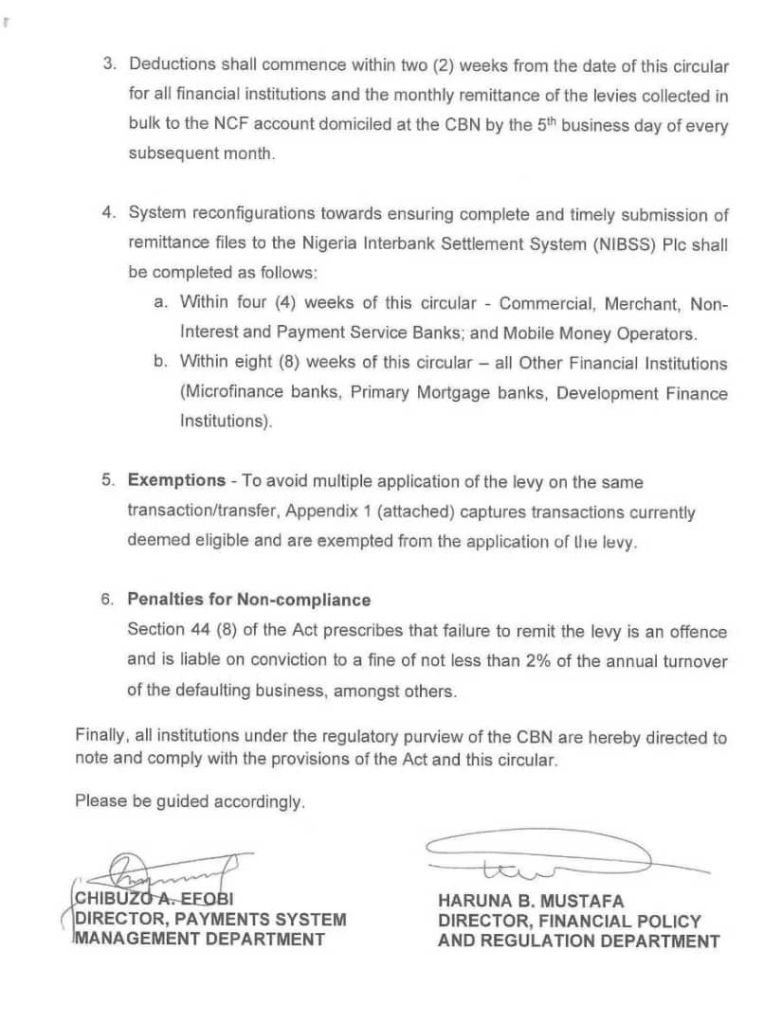

The Central Bank of Nigeria (CBN) has instructed banks and payment services operators to deduct a 0.005 percent Cybersecurity Levy on electronic transfers. This directive, outlined in a circular issued by the Director of Payment Services, Uzoma Efobi, will take effect in the next two weeks.

The levy, to be applied at the transaction origination point, will be aggregated and deposited into the Cybersecurity Fund held by the CBN. The apex bank cautioned that institutions failing to comply could face fines of not less than two percent of their annual turnover.

However, interbank transfers and loan transactions are exempted from this cybersecurity levy.

This circular follows up on earlier communications dated June 25, 2018, and October 5, 2018, regarding compliance with the Cybercrimes (Prohibition, Prevention, Etc.) Act 2015. With the recent enactment of the Cybercrime (Prohibition, Prevention, etc) (Amendment) Act 2024, a levy of 0.5 percent (0.005) of all electronic transaction values specified in the Second Schedule of the Act must be remitted to the National Cybersecurity Fund, administered by the Office of the National Security Adviser.

The deducted amount will be reflected in customers’ accounts with the narration, ‘Cybersecurity Levy.’

In a related development, just a week ago, the Federal Government commenced the deduction of ‘Stamp Duty’ on mortgage-backed loans and bonds, with Deposit Money Banks instructed to deduct 0.375 percent stamp duty charges.

Leave a comment